We receive numerous calls on a daily basis asking questions about their insurance or bills. I decided to answer a few of the questions that kept popping up to help patients understand more about how insurance works, and why it’s important to understand your benefits before you come into the office. Many patients do not know that they are able to use their medical insurance for their eye exam, and although they may not have a vision plan to cover their frame, lenses and contacts lenses they are still able to receive a comprehensive eye exam from a specialist.

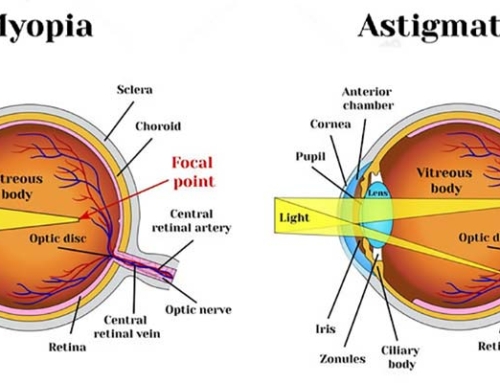

A vision plan is different than medical insurance as it is an additional benefit that some patients may have to be used for “routine” eye exams. They also provide certain allowances to be used towards the purchase of frames, lenses, and contact lenses. Some patients may have ‘exam only’ benefits which will cover a basic eye exam for the purpose of checking if there is any vision correction such as myopia, hyperopia, astigmatism and/or presbyopia. Under a vision plan, a medical diagnosis cannot be used such as dry eye, cataracts, glaucoma, diabetes etc. Meaning, if you come into the office with a complaint or symptom your vision plan eye exam benefits would not cover that exam. We would then apply the exam to your medical insurance and charge you your specialist co-payment. Some patients will have material benefits with their Vision Plan to be used for the purchase of frames, lenses or contacts. Some vision plans have a set allowed amount, some have a discount allowed, and all use co-payment charges for upgrades like lens coatings, lens materials, and lens types. Materials like frames, lenses or contacts are not covered by your medical insurance.

Medical health plans cover many eye conditions such as dry eyes, conjunctivitis, blepharitis, styles, floaters, diabetes, hypertension, glaucoma, headaches etc. However, medical insurance cannot be used for vision conditions for the purpose of glasses and or contact lenses. However, many patients are not aware that we provide eye care by using their medical insurance. Patients are able to take advantage of their health plan for their comprehensive eye exam and we are able to work with our patients if any glasses and or contact lenses are needed outside of their medical insurance even if they don’t have a vision plan.

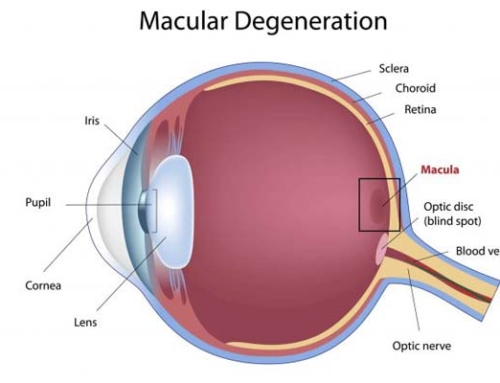

The chief complaint will usually determine which insurance or what benefit we will use. There are many times during a routine eye exam where we are screening for eye conditions and we find certain risk factors for glaucoma, macular degeneration, cataracts etc. At that point, we would make the determination of which insurance we will need to use for the examination. There is additional testing that will be needed to help diagnose and manage certain conditions that a vision plan will not cover. At that point, we would use the medical insurance for the comprehensive eye exam and additional testing, and use the vision plan for materials, such as glasses and/or contact lenses if needed. Patients with a chronic condition such as glaucoma, diabetes or dry eye will always use their medical insurance, which involves a specialist copayment, and in some cases meet their deductible.

This is probably our most common question, and this goes for any medical professional you use your medical insurance with. Some medical health plans have yearly deductibles that a patient must pay before the insurance company will make any additional payments. A deductible is a defined amount set up by the insurance company that the patient is responsible for paying out of pocket before the insurance pays a claim. The deductibles vary by insurance carriers and range from $0 to upwards of $2,000. The stipulations as to when the deductible gets applied also varies by plan and carrier. When we submit a claim, we are not aware of the patient has met their deductible so in those instances we will charge the patient their co-payment, and if a claim gets charged to their deductible we will then bill the patient for the remaining balance. After your deductible has been met with your insurance then every visit will only have a co-payment amount. Some insurances cover for example 80 percent of U&C fees. In those situations, we will submit a claim to your insurance company and they will let us know if any additional charge needs to be paid.

Medicare Part B covers vision care in some instances. Medicare Part B is considered a medical insurance so medical eye exams and conditions are covered. However, if a patient has had cataract surgery Medicare will cover vision correction for a pair of glasses after cataract surgery.

This is not really a common question, but it is a very useful benefit that many people are not aware of. A Health or Flex Spending account is a health benefit that some employers offer to be used for health-related expenses. Patients will put pre-taxed money aside to be used for out of pocket health expenses for you, your spouse and your children. It can be used for your co-payments, deductibles, glasses, contact lenses and sunglasses all pre-tax. A patient who has these benefits should take advantage of these savings as they usually do not roll over and must be used before the end of the year.